Qdro pension calculation

A QDRO must include the amount or percentage of your former spouses benefits to be paid to you. A present value report provides the current lump sum value of the accrued pension at the normal retirement age.

What Is A Qualified Domestic Relations Order Qdro Smartasset

Calculator 1 Quick Trace From Date of Marriage through Date of Separation With Statements Step 1.

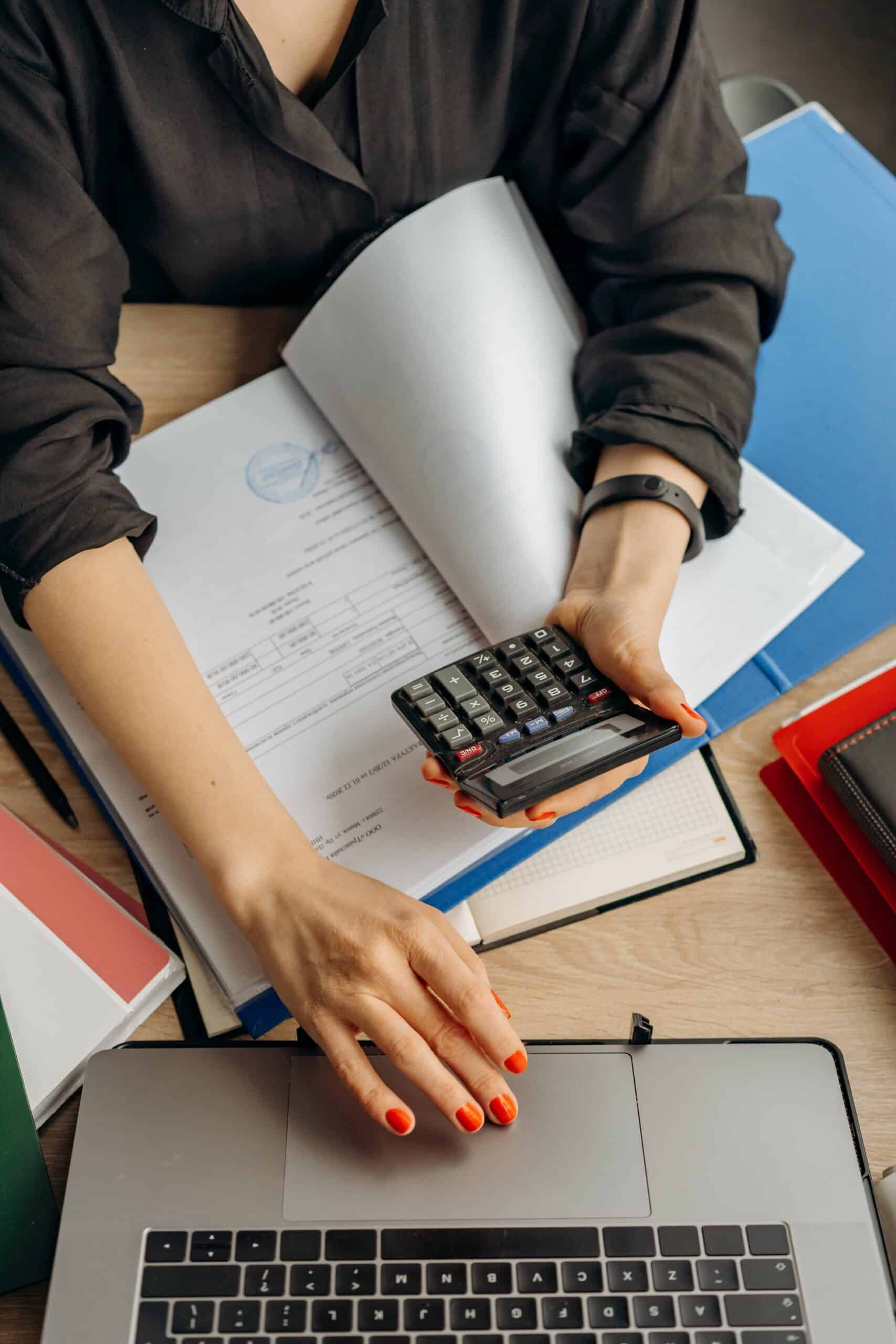

. Determine the amount of participants. Divide the service credit from date of marriage until date of separation by your total service credit. The basic calculation steps for a separate interest QDRO are as follows.

Assignment of retirement benefits in a domestic relations proceeding and the requirements that apply in determining whether a domestic relations order is a qualified domestic relations order. Retirement plans can be defined contribution plans defined benefit plans or. Practically speaking I would be really honked off if at the time of.

Defined benefit pension plans provide retirees with a predetermined monthly retirement benefit upon reaching a specific age. It often erroneously states retirement plan without ever defining the type of plans to be divided. 12000 years accrued during.

Payee do you really have a QDRO. Enter your Date of Marriage Date of Separation beginning balance typically your. In your situation this means you step into the shoes of your former spouse.

Between divorcing parties by Qualified Domestic Relations Order QDRO as set forth under Employee Retirement Income Security Act ERISA and Section 414p of the Internal. This service includes discovery when you provide the correct authorization. In other words if you have to ask how to calculate the payment to the alt.

When dividing a pension plan a Qualified Domestic Relations Order will often be used. This order specifies that someone other than the employee. The retirement benefit paid to a retiree is typically calculated.

How is a QDRO calculated. Basics of separate interest QDRO calculations. The numerator of the fraction is the present value of the benefits payable to the spouse or former spouse.

How To Calculate QDRO Determine the present value of the participants retirement benefit. Calculate the amount assigned to the alternate payee based on the QDROs. The denominator is the present value of all benefits payable to the.

What Is A Qualified Domestic Relations Order Qdro Smartasset

Qdro Calculating A Pension S Present Value Steven L Abel Esq Qdros

Qdro Pitfalls And Assessing Present Value Calculations

How Is Qdro Calculated Skyview Law

Dividing Retirement Assets In Divorce With A Qualified Domestic Relations Order Qdro Round Table Wealth

2

It S A Simple 401 K Qdro What Could Go Wrong Moon Schwartz Madden

Frisco Retirement Asset Division Lawyers Collin County Property Division Attorneys

A Primer On Pension Valuation In Divorce

What Is The Brown Rule What Is The Time Rule Formula Qdro Helper

Divorce And Your Mpers Benefit Modot Patrol Employees Retirement System

Ex11 Jpg

How Is Qdro Calculated Skyview Law

Fire Police Pension Fund San Antonio

How To Calculate The Value Of A Pension For Divorce

A Primer On Pension Valuation In Divorce

How To Calculate The Value Of A Pension For Divorce